Purchasing a home can be a challenge, especially for the first time. With so many steps and so much money involved, mistakes are often costly. But buying your first home doesn’t have to be difficult! In this guest article from realtor Dan Hamilton, he breaks down the home buying process for you, with special tips just for first-time buyers and buyers looking for a home in Greenville, SC.

Preparing to Buy a Home

Before you can start shopping for your very first home, you have to make sure you have money to spend!

Start Saving Early

There are many costs associated with purchasing a home, especially for the first time. Here are just a few to consider:

- Down Payment: Your down payment, or cash deposit on your new home, will vary depending on the cost of the home and your mortgage. Some mortgages allow as little as 3% down, but even that is no small sum. For example, a 3% down payment on a $250,000 home is still $7,500.

- Closing Costs: Costs associated with finalizing your mortgage. These typically range between 2% to 5% of the loan amount, but can sometimes be passed in part to the seller during negotiations (more on that later).

- Move-In Costs: Don’t forget about post-closing purchases! It’s a good idea to set aside a little cash for a fresh coat of paint, minor repairs, or additional furnishings.

If you are eager to start saving money, assess your current spending habits and determine if expenses can be trimmed. Make sure your savings are invested in a savings account or a CD so they can begin accumulating interest. Finally, if you have the option, you can ask your employer to deposit your paychecks into multiple accounts. That way you automatically have money going to savings every pay period. The earlier you save, the bigger difference it makes in your overall savings.

Check and Strengthen Your Credit Score

Your credit score plays a role in the home financing process. To keep it high, pay all your bills on time, keep current lines of credit open, and do not open new lines of credit.

If you need to raise your score, there are a few ways to do so. First, if you encounter any errors in reporting, you can write to the bureau and dispute the errors. Second, if you have any one-time mistakes such as a late bill payment, you can appeal to the company that registered the mistake and it may be removed. Finally, avoid errors in the future! Raising your credit score often takes time, so be patient and start well in advance of your home purchase.

Mortgage Selection Tips

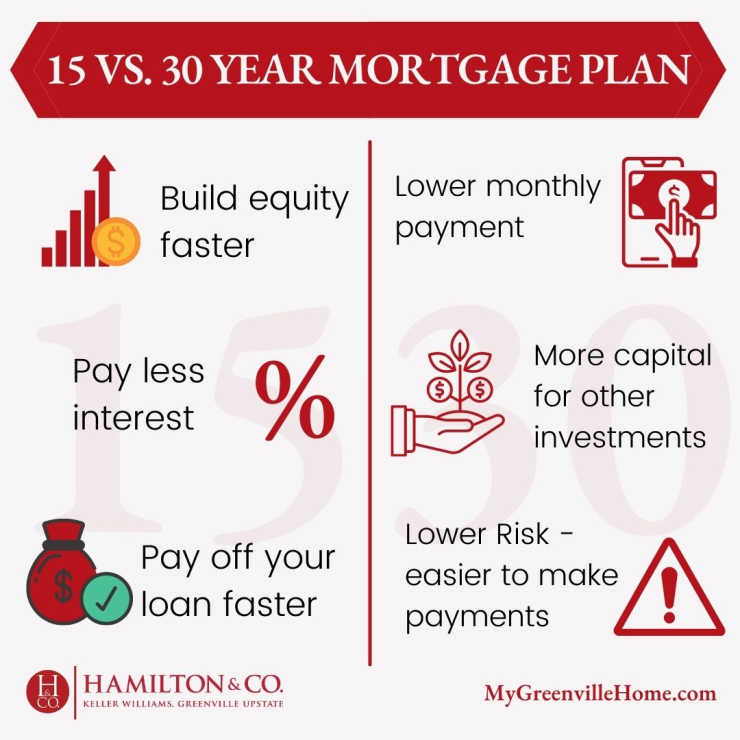

Once you have saved sufficiently, it’s time to talk about investment. There are a few different types of home loans, including Conventional, FHA, VA, and USDA, available to homebuyers depending on financial status, home location, veteran status, and more. Additionally, mortgages are divided into 15-year and 30-year mortgages depending on the monthly payment that is best for you.

The best way to determine what type of mortgage you will need (and what type of home you can afford) is to get in touch with a qualified financial expert. In addition to helping you understand what you should be looking for in your first home, a lender can help you get pre-approved, an important and necessary first step in the home buying process.

“Getting pre-approved before looking for a home is a must,” Buyer’s Agent Mark Hoyt explains, “Doing so shows the sellers they can trust you to purchase your home and saves a lot of time in the long run.”

At Hamilton and Company, we regularly work with a number of local lenders to ensure our clients have access to the best financial support in the Upstate. Allex Lilla at Homeside Financial is just one of many partners who has helped dozens of our clients obtain competitive rates and low down payments on their mortgages. If you need a lender recommendation based on your goals, we’d be happy to provide one!

Home Shopping Tips

You’ve saved your money, done your research and gotten pre-approved to purchase a home. Now you can actually shart shopping!

Choose a Real Estate Agent Carefully

Your real estate agent is like a lawyer, representing you in the unpredictable and overwhelming world of the housing market. A good agent is a friend and a guide, answering your questions and negotiating on your behalf.

Having a strong, experienced agent on your side is even more important when it comes to purchasing your first home. Let your agent help navigate available listings, determine when to put in an offer (and for how much), and advocate for you during the repair negotiations and at the closing table.

In addition to being the top-ranked real estate group in the Upstate, Hamilton and Company’s talented team of buyers agents and listings agents makes exceeding client expectations their top priority. With over 30 years of collective experience, our team brings experience and passion to the table, working hard to find the perfect house for you right here in Greenville.

Pick the Right Type of Neighborhood and House

When shopping for a home, be realistic about your desires and expectations.

Fixer-upper or new build? Townhouse or single-family home? HOA? Starter home or forever home? Neighborhood amenities? Your agent will walk you through these questions and more to help you determine what you are looking for here in Greenville.

Understanding exactly what you are looking for helps you stay focused and, in hot markets like we are experiencing this year, helps you make a quick decision. But don’t get too caught up in your wish list. Jevon Clarke, one of our Listing Agents here at Hamilton and Company, sets his clients’ expectations by reminding them that “perfect house” and “perfect timing” don’t always align. It is important to know what you are looking for and still be flexible.

If you are new to Greenville and struggling to decide where you want to settle, check out Hamilton and Company’s Neighborhood Guides for a detailed breakdown of each real estate community.

Stick to Your Budget

Just like it is important to have expectations for the type of home you want, you must also have budget expectations. Your mortgage broker and subsequent loan should give you a good understanding of your budget, and it is important to stick to it. Many first-time homebuyers “window shop” and are suddenly disillusioned with the more realistic options. Be honest with your real estate agent about your budget, expectations and desires so they can help you find the best home for you.

Understand too that the 2021 real estate market is a little different than what most buyers are used to navigating. Interest rates are low, buyer demand is up, and while home inventory has recovered slightly since the summer, it is still unusually low. Purchasing a home in this environment requires advanced planning, patience, and quick decisions!

The right agent can help you navigate the stressors of the current market so you can take advantage of market strengths like low-interest rates, which make homes more affordable despite inflation and other economic factors.

Keep Your Emotions in Check

Speaking of stressors, shopping for a home is not for the faint of heart. Especially in a market like we’ve experienced this year in Greenville, purchasing a home is often a frenzied rush of denied contracts, split-second decisions, and bidding wars. Stacey Barton, Buyer’s Agent at Hamilton and Company, admits that in fast-paced markets such as these, buyers need to be prepared to make a few offers. Does this mean giving up and waiting for calmer days? No! With the right agent on your side, you can and will succeed in buying your first home in Greenville. Just be patient!

Home Purchasing Tips

So (at long last) you think you’ve found the one. What’s next?

Negotiate with the Seller

Take it from us – everything is up to negotiation. That listing price is not the final price and can be increased or decreased depending on nearby home values and the area of the Upstate in which you are home shopping. It is important to know your limits and be flexible within them.

If your sellers aren’t willing to budge on listing price, there are always other options available to you. For example, your sellers might be convinced to cover closing costs, provide additional stipends for repairs, or leave behind furnishings and appliances.

Owner flexibility in a negotiation often depends on the state of the real estate market at large in the Upstate. For the last year, the dramatic increase in buyer demand has put sellers in a position of negotiating power, resulting in what we call a seller’s market. If you are in a situation where your desired home is receiving multiple offers, you may not be in a position to demand much from the sellers. However, as the market starts to slow down, we’re seeing more fair negotiation between buyers and sellers.

Ultimately, negotiation tactics depend on your financial situation, the popularity of the house in question, the state of the market, and a host of other factors. A knowledgeable real estate agent can help you understand the best move based on your unique situation and help you get that house for the best price possible.

Pay For a Home Inspection

Once you have your new home under contract, a professional inspection is a must. A licensed inspector looks for potential problems around the home so you can make an informed decision about buying or backing off. A few tips regarding inspections:

- Know what your inspector is looking for (and what they aren’t). Standard inspections do not typically cover issues like radon, mold, or pests, so it is important to pay for additional tests if you think these problems might manifest.

- Keep track of all paperwork as well as who is responsible for what repairs. Before closing on your home, it is your responsibility to ensure all necessary repairs have been made (more on this later). Your real estate agent will also help with this process.

- It is traditional for the homebuyer to accompany the inspector on the appointment. While on the property, you can make sure the inspector is thorough, ask any questions you have, and get a better understanding of the home. After the appointment, you receive a detailed report that you and your real estate agent can use to start the repair process with the seller.

Buy Adequate Home Insurance

Home insurance is an important investment that many homebuyers forget about. After all, your home is likely to be the biggest purchase of your life, why not insure it? Home insurance offers protection in the event of fire, flood, theft, or other disaster. At Hamilton and Company, we have a number of highly reputable home insurance companies our clients recommend. We’d be happy to share them with you!

The Final Walkthrough

Before you close on your new Greenville home, you will have the opportunity to walk through one more time. This is your opportunity to assess repairs, determine if additional work is needed, and generally just make sure you are ready to sign!

A few tips:

- Read through notes and reports from previous inspections and see if any repairs have been missed.

- Make sure all appliances, plumbing and light fixtures are working properly.

- If the seller has agreed to leave appliances, furnishings, or other belongings behind for you, make sure all are present and accounted for.

- Ensure the property is clean, but don’t worry about a little dirt. Contractually, sellers are asked to leave the home “broom clean,” not scrubbed to death.

Remember, this is your last chance to request repairs or changes on the part of the seller before closing!

Moving Into Your New Home

After months of preparation, shopping, and negotiation, the day is finally here: you are moving into your new home!

Hire a Professional Cleaner

Hire a cleaning service to give the home a thorough clean, especially if contractors have been to make repairs or improvements. Walking into a clean slate on moving day helps you feel ready to make the home your own.

Change the Locks

You don’t know who your home’s previous owners shared keys with, so it is always a good idea to get the locks changed. This may seem small, but as a homeowner, home security is very important. Your landlord isn’t liable anymore – you are!

Find the Best Local Takeout

Ok, enough with real estate and home advice. Move-in day is crazy and you definitely won’t have the time (or the kitchen) to make dinner. The most important thing left on your list is to find the best takeout spot on your block and enjoy your first meal in your new home. Congratulations, you are a homeowner!

Are you interested in starting your search for your dream home? Our team of local Greenville experts is ready to help! Don’t hesitate to contact us at 864.527.7685 to learn more about purchasing a home in the Upstate.

Want to learn more about buying your first home?

Contact Dan Hamilton to learn more.

Hamilton & Co. of Keller Williams Greenville Upstate

403 Woods Lake Road, Suite 100

Greenville SC 29607

864.527.7685